Building on the momentum from 2025, brokers and underwriters now face a landscape where adaptability, precision and digital execution are expected, rather than just sought-after.

Soft market dynamics and capital deployment pressure

With contracting rates, ample capacity in many lines, and growing broker leverage, carriers are being pushed to deploy capital faster and at lower cost.

However, rate contractions do not necessarily mean that London-listed carriers are shrinking. In fact, the increase in Smart Follow and digital underwriting methods means that some leading carriers are still continuing to grow premium by improving their responsiveness and data-led risk selection.

Appetite precision, underwriting governance and operational cost reduction are all critical levers in a competitive environment where volume is no longer guaranteed.

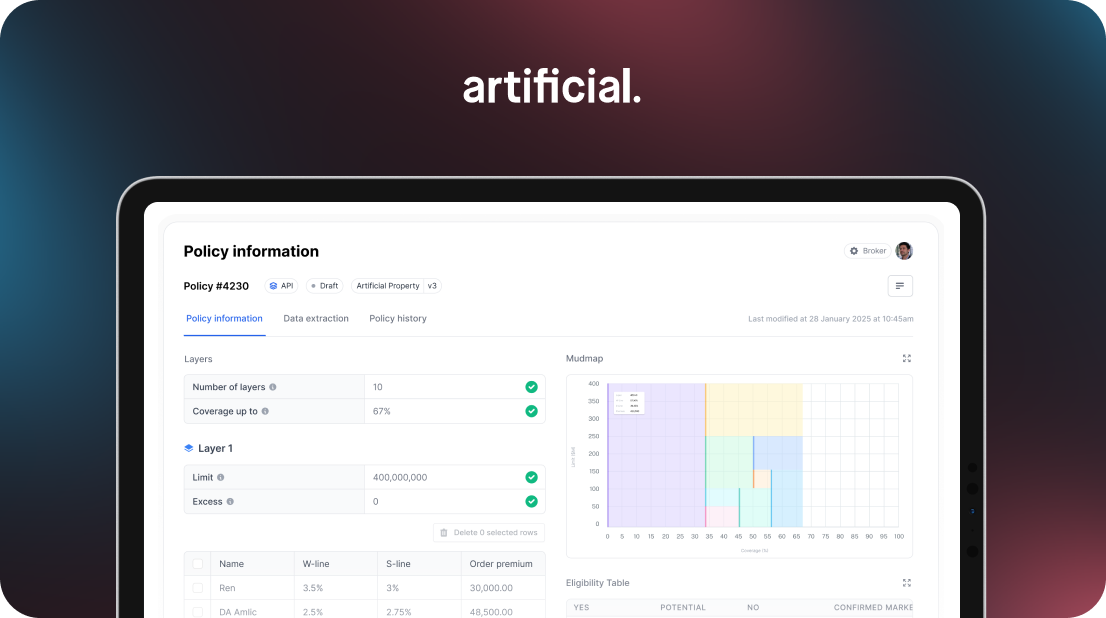

Artificial’s Smart Underwriting product supports this shift by enabling configurable capital deployment strategies across lead, follow and consortia models. By codifying rules, automating triage and embedding structured data, carriers can write more business while protecting margins and control.

Digital broking and Smart Facilities will become integral to the London market

Soft market conditions also push brokers to grow volume while protecting margins, making digital facilities an efficient, scalable solution.

As such, we believe digital facilities will emerge in 2026 as a dominant model for leading brokers who wish to distribute capacity more effectively and streamline placement strategies at scale.

In 2026, digital broking will move from early adoption to standard practice. Brokers such as McGill and Partners are investing in technology to grow revenue, scale operations and reduce dependency on manual effort. This shift is driven not just by efficiency, but by necessity: clients expect speed, accuracy, and transparency as standard.

→ Read more about the rise of digital broking in our white paper

Artificial’s Smart Placement plays a central role in this transformation. It consolidates the full broking workflow, including data ingestion, contract creation and digital facility management, into one intuitive interface, allowing brokers to place more risks with less friction.

Brokers using Smart Placement have reported doubling premium volumes in new facilities and significantly reducing operational cost per placement.

AI will become more operational

The last year saw artificial intelligence shift from pilot programmes to production infrastructure. In 2026, AI is embedded across underwriting, triage, documentation and service workflows. The purpose of this shift is not to replace human judgement, but more about enabling underwriting teams to focus on the risks that matter most.

According to a Reuters report, ‘artificial intelligence and generative AI are among the most popular technologies European insurers plan to invest in. As shared by respondents, 62% plan to invest in generative AI, and 56% plan to invest in machine learning and AI over the next three years.’

This year will also see an increase in exploration of Agentic automation models. Where 2024 and 2025 saw companies testing the waters into generative AI, agentic AI will be the buzzword of 2026.

Agentic AI models are increasingly being deployed in specialty underwriting, where they support structured document processing and cross-channel communication. These technologies can result in faster time to quote, increased data accuracy and improved capital efficiency without expanding headcount.

ESG, climate exposure and parametric growth

Environmental and sustainability factors are continuing to shape underwriting strategies and product design. In 2026, ESG metrics will be embedded into capital allocation models, while climate risk modelling is advancing rapidly, particularly for sectors like property and agriculture.

Parametric products, which are policies that trigger based on predefined events like wind speed, temperature or flood depth, are gaining ground. These solutions provide faster claims resolution, clearer triggers, and improved customer experience. They also represent a viable option for climate-exposed risks that traditional models struggle to price.

Carriers must now account for ESG within their underwriting governance, while brokers are increasingly expected to guide clients through climate disclosures and sustainability-linked coverage structures.

Talent transformation and technology fluency

As automation absorbs repetitive, manual tasks, the skills required in broking and underwriting are shifting. In 2026, analytical thinking, systems fluency, and client engagement will be paramount. The competition for digitally capable talent will increase, and firms will focus on training and technology adoption to unlock productivity and scale.

Underwriters are becoming data analysts and risk strategists. Brokers are becoming platform power users and trusted advisors. Platforms like Artificial’s Smart Placement and Smart Underwriting are enabling this transition, not just by reducing manual effort, but by elevating the impact of each role through workflow consolidation and better insights.

Conclusion: Precision, scale and readiness

The year ahead will reward firms that can move quickly, price accurately, and scale intelligently. Whether it’s through digital facilities, codified underwriting rules or real-time data ingestion, the market leaders in 2026 will be those who combine operational readiness with a strategic view of risk.

By investing in platforms like Smart Placement and Smart Underwriting, brokers and carriers can future-proof their operations, grow more efficiently, and deliver differentiated outcomes in a market that is rapidly changing.

If you'd like to learn more about how Artificial can support your digital transformation in 2026, get in touch with us today.